Over the last month, the Wellingborough property market

has seen some interesting movement in house prices, as property values in the Wellingborough

Borough Council area rose by 2.2% in the last month, to leave annual price

growth at 7.9%. These compare well to the national figures where property

prices across the UK saw a monthly uplift of 0.42%, meaning the annual property

values across the Country are 8.3% higher, this is all despite the constraining factors of Stamp

Duty changes in the spring and more recently our friend Brexit.

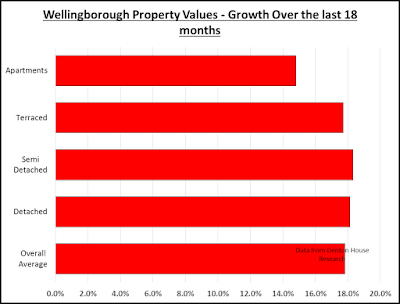

Looking at the

figures for the last 18 months makes even more fascinating reading, whereby

house prices are 17.8% higher, again thought provoking when compared to the national

average figure of 13.6% higher.

However, it gets more remarkable when we look at

how the different sectors of the Wellingborough market are performing. Over the

last 18 months, in the Wellingborough Borough Council area, the best performing

type of property was the semi, which outperformed the area average by 0.41% whilst

the worst performing type was the apartment, which under-performed the area

average by 2.61%.

Now the difference doesn’t sound that much, but

remember two things, this is only over eighteen months and the gap of 3.02% (the

difference between the semi at +0.41% and apartments at -2.61%) converts into a

few thousand pounds disparity, when you consider the average price paid for a semi-detached

property in Wellingborough itself over the last 12 months was £165,300 and the

average price paid for a Wellingborough apartment was £103,800 over the same

time frame.

I know all the Wellingborough landlords and

homeowners will want to know how each of the property types have performed, so

this is what has happened to property prices over the last 18 months in the area...

·

Overall

Average +17.8%

·

Detached

+18.1%

·

Semi

Detached +18.3%

·

Terraced +17.7%

·

Apartments

+14.8%

So what

does all this mean to Wellingborough homeowners and Wellingborough landlords

and what does the future hold?

When

I looked at the month-by-month figures for the area, you can quite clearly see there is a slight tempering of the Wellingborough

property market over these last few months. I have mentioned in previous

articles that the number of properties on the market in Wellingborough has increased

this summer, something that hasn’t happened since 2008. Greater choice for

buyers means, using simple supply and demand economics, that top prices won’t

be achieved on every Wellingborough property. You see, some of that growth in Wellingborough

property values throughout early 2016 may have come about because of a surge in

house purchase activity, an indirect result of the increase in stamp duty on second homes from April, thus providing

a temporary boost to prices.

However, it may be possible the

recent pattern of robust employment growth, growing real earnings and low

borrowing costs will tilt the demand/supply seesaw in favour of sellers and

exert upward pressure on prices once again in the quarters ahead.

No comments:

Post a Comment